Top 10 Global Semiconductor Companies Leading the Industry in 2025

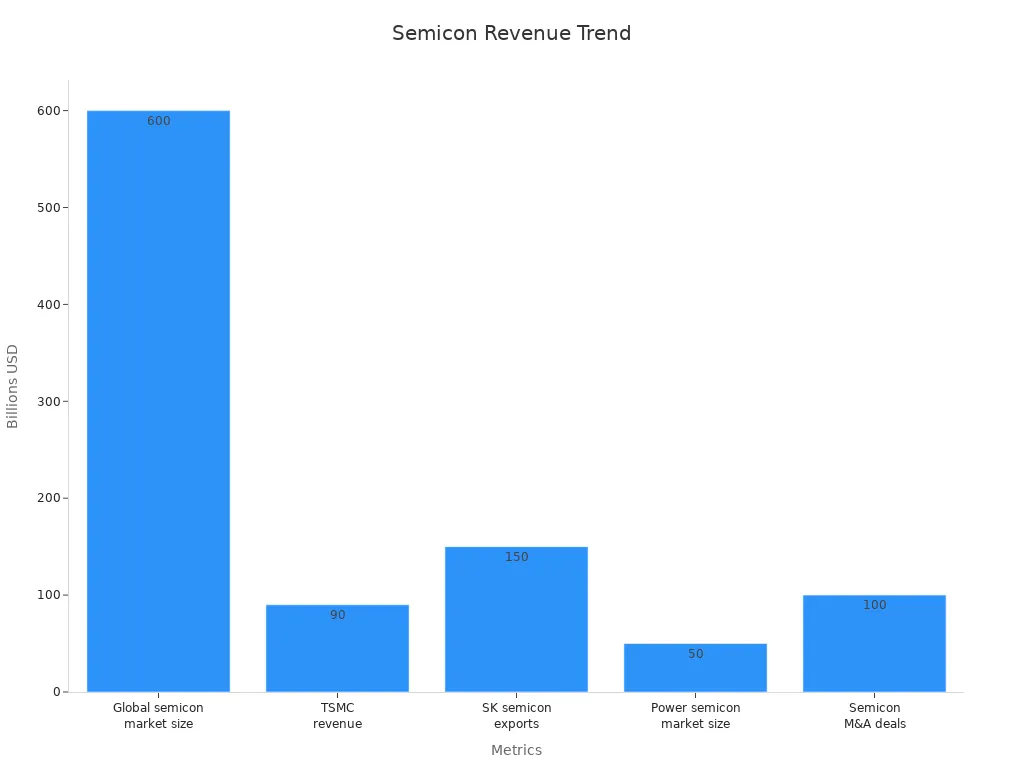

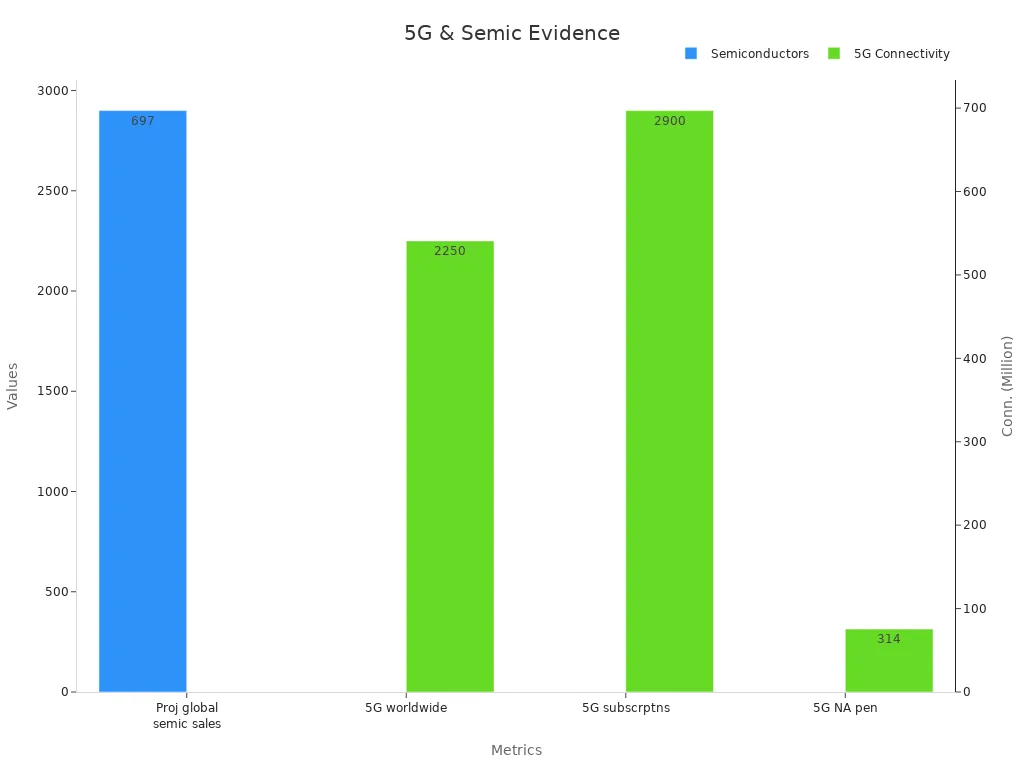

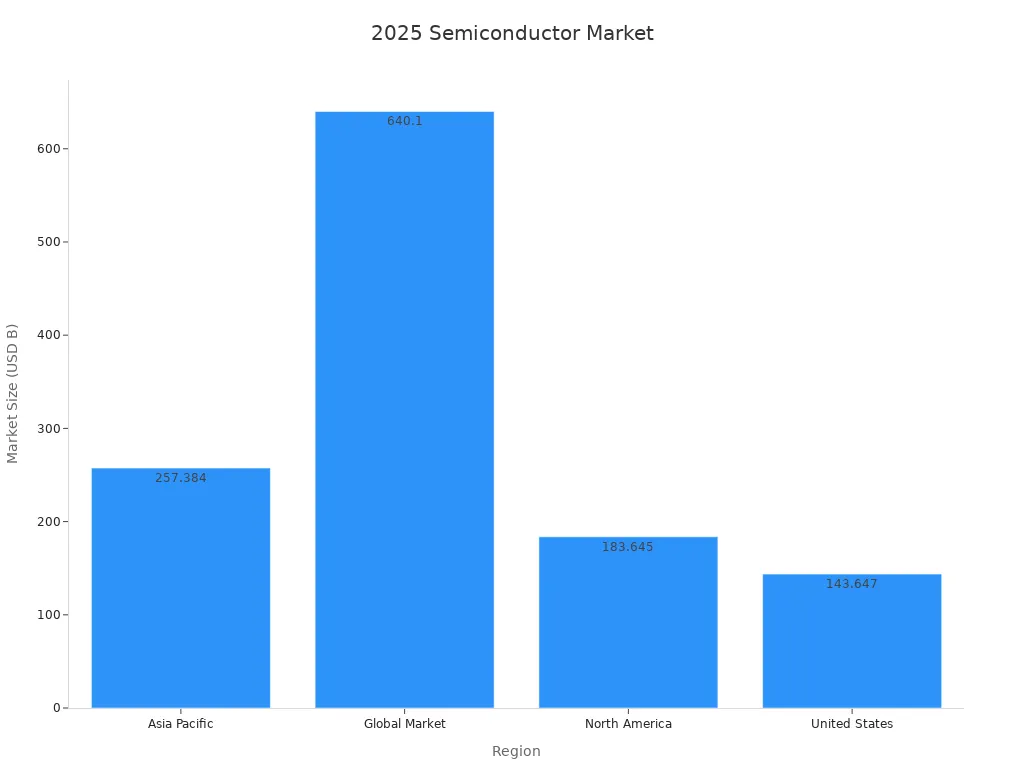

The top 10 global semiconductor companies in 2025 include Samsung Electronics, NVIDIA, TSMC, Intel, Broadcom, Qualcomm, SK Hynix, ASML, AMD, and Texas Instruments. Selection relies on revenue, market capitalization, technology leadership, and global influence. These leaders drive innovation across AI, automotive, and 5G, fueling record growth. In 2025, industry sales are set to reach $697 billion, with the top 10 firms holding a combined market cap of $6.5 trillion.

Key Takeaways

The top 10 semiconductor companies in 2025 lead through strong market value, innovation, and global reach.

AI, automotive chips, and 5G technology drive fast growth and high demand in the semiconductor industry.

Companies invest heavily in research and development to create advanced chips and stay competitive.

Asia Pacific dominates semiconductor manufacturing, with Taiwan, South Korea, and China as key players.

Future success depends on innovation, flexible supply chains, and adapting to new technology trends.

Criteria Overview

Market Leadership

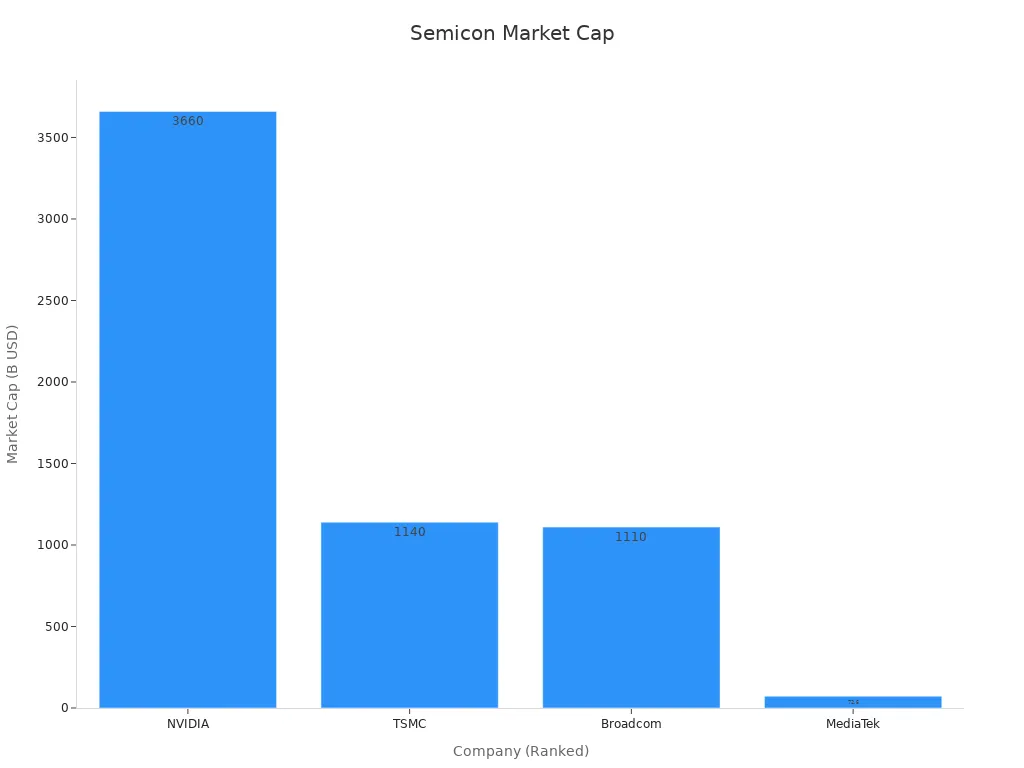

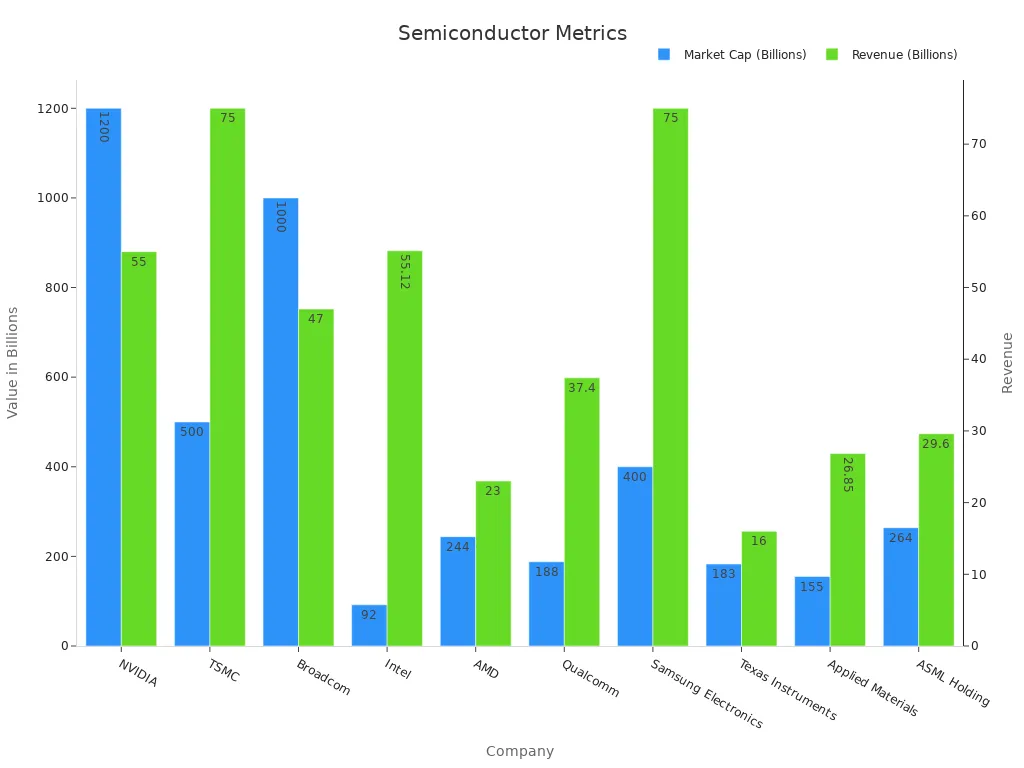

Market leadership in the semiconductor industry depends on several measurable factors. Companies at the top often show high revenue and large market capitalization. In 2025, the leading firms have market caps ranging from $29 billion to over $3 trillion. The following table highlights the market cap of the top players:

Rank | Company | Market Capitalization (2025) | Key Market Segment(s) |

|---|---|---|---|

1 | NVIDIA | Over $3 trillion | AI computing, GPUs, data center acceleration |

2 | Broadcom | Over $1 trillion | 5G, broadband, enterprise networking |

3 | TSMC | Over $1 trillion | Foundry services, advanced chip manufacturing |

4 | ASML | ~$301 billion | EUV lithography equipment |

5 | Samsung | ~$245 billion | Memory chips, foundry services |

These numbers show that only companies with significant financial strength and market share can lead the industry. Market leadership also reflects dominance in key segments such as AI, 5G, and advanced manufacturing.

Innovation

Innovation drives the growth and competitiveness of semiconductor companies. In 2025, the industry invested over $21 billion in research and development. More than 3 million patents have been filed, and over 1,700 mergers and acquisitions took place. These actions show a strong commitment to new technology and product development. Companies also added 240,000 new professionals last year, expanding their talent pool and expertise.

Note: High R&D spending and patent activity signal a company's ability to create cutting-edge solutions for AI, automotive, and connectivity markets.

Global Impact

Global influence measures how far a company's technology reaches and how it shapes the industry. For example, Arm technology powers 99% of smartphones and supports nearly every major automotive manufacturer. The Arm developer ecosystem includes over 22 million software developers worldwide. Many leading companies participate in global initiatives and adapt to international regulations, showing leadership beyond technology. These factors make global impact a key criterion for ranking semiconductor companies in 2025.

Industry Trends

AI and Machine Learning

Artificial intelligence (AI) and machine learning have become the main drivers of growth in the semiconductor industry. The global AI market is growing at a compound annual rate of 55.6% by 2025. AI accelerator chips, which help computers learn and make decisions, are expanding at about 18% each year. This rate is five times faster than other chip applications. Companies are investing more in research and new factories. For example, SK Hynix and Micron plan to increase their capital spending by 75% and 45% in 2025. The industry expects to grow by 11% year-over-year, mostly because of AI and data center demand. AI also helps engineers design chips faster and improves how chips are packaged, making them more powerful and efficient.

Note: The SEMI ISS 2025 event predicts that the semiconductor market will reach nearly $1 trillion by 2033, with AI leading the way in innovation and productivity.

Automotive and EVs

The automotive and electric vehicle (EV) markets rely heavily on advanced chips. In 2025, the global automotive semiconductor market will reach $77.27 billion. Experts expect this market to grow at 8.3% each year until 2032. Passenger vehicles make up 66.1% of this market, while discrete power components account for 31.9%. Asia Pacific leads with almost half of the market share. As more electric cars hit the roads, the need for chips in vehicles rises. By 2030, half of all cars worldwide will use electric powertrains. In the past year, over 1 million electric cars were produced, showing strong demand for automotive chips.

Metric/Segment | Value/Share (2025) |

|---|---|

Global Automotive Semiconductor Market Size | |

CAGR (2025-2032) | 8.3% |

Asia Pacific Market Share | 45.5% to 47.8% |

Passenger Vehicles Market Share | 66.1% |

Discrete Power Components Share | 31.9% |

Body Electronics Applications Share | 24.9% |

5G and Connectivity

5G technology connects billions of devices and powers new digital experiences. In early 2025, there are over 2.25 billion 5G connections worldwide. By the end of the year, this number will reach 2.9 billion. North America alone has 314 million 5G connections, covering 83% of its population. The industry supports this growth by expanding advanced chip manufacturing. From 2024 to 2028, the capacity for making the most advanced chips (7 nanometers and below) will grow by about 69%. Factories will produce 1.4 million of these wafers each month by 2028, up from 850,000 in 2024. These efforts help meet the rising demand for faster and more reliable wireless networks.

Top Semiconductor Companies

Samsung Electronics

Samsung Electronics, based in Suwon, South Korea, stands as a global leader in memory chips and advanced logic semiconductors. In 2025, the company reached a market capitalization of $400 billion and generated approximately $75 billion in revenue. Samsung employs over 260,000 people worldwide. The company continues to excel in DRAM and NAND flash memory, supplying chips for smartphones, cloud computing, and artificial intelligence. Samsung has invested heavily in advanced logic chips and packaging innovations. In 2025, the company sampled DDR5 and HBM4 memory and became an early adopter of gate-all-around (GAA) transistors at the 3 nm node. Samsung also secured major clients for older process nodes, such as Google’s Tensor G5. However, the company faces challenges in foundry yields, with a 3 nm process yield of about 50%, trailing behind TSMC. Samsung’s strategic hiring of former TSMC executives aims to improve process engineering and foundry competitiveness.

NVIDIA Corporation

NVIDIA Corporation, headquartered in Santa Clara, California, leads the industry in graphics processing units (GPUs) and artificial intelligence hardware. In 2025, NVIDIA’s market capitalization soared to $1.2 trillion, with annual revenue reaching $55 billion. The company employs around 26,000 people. NVIDIA’s Blackwell AI chips set new standards for machine learning and data center acceleration. The company holds an estimated 80% share of the AI accelerator market. NVIDIA’s data center revenue has grown rapidly, reflecting strong demand for AI and cloud computing solutions. The company’s GPUs power applications in automotive, robotics, and scientific research. NVIDIA’s focus on innovation and ecosystem partnerships keeps it at the forefront of semiconductor companies driving the AI revolution.

TSMC

Taiwan Semiconductor Manufacturing Company (TSMC), based in Hsinchu, Taiwan, is the world’s largest independent foundry. In 2025, TSMC’s market capitalization exceeded $500 billion, and its revenue reached $75 billion. The company employs more than 65,000 people. TSMC leads in advanced chip manufacturing, with near 90% yield on its 3 nm process and early risk production of 2 nm technology. The company attracts high-profile customers due to its superior yields and premium pricing. TSMC’s foundry services support a wide range of industries, including smartphones, automotive, and high-performance computing. The company’s commitment to process maturity and capacity expansion ensures its leadership in global chip supply.

TSMC’s advanced 3 nm and 2 nm nodes have set new benchmarks for efficiency and performance, making it the preferred partner for many leading technology firms.

Intel Corporation

Intel Corporation, headquartered in Santa Clara, California, remains a major force in computing and semiconductor innovation. In 2025, Intel’s market capitalization reached $92 billion, with revenue of $55.12 billion and a workforce of 125,000. Intel focuses on next-generation chips for computing, cloud, and AI. The company invests in domestic production and foundry services to strengthen supply chain resilience. In 2023, Intel launched the Habana Gaudi2 AI chipset, which delivers up to 20 times higher performance than previous solutions. Intel’s efforts to regain process leadership and expand foundry capabilities position it as a key player in the evolving semiconductor landscape.

Broadcom Inc.

Broadcom Inc., based in San Jose, California, specializes in networking, broadband, and enterprise software. In 2025, Broadcom’s market capitalization reached $1 trillion, with annual revenue of $47 billion and a workforce of 20,000. The company’s AI-powered networking solutions and green energy initiatives drive growth across data centers and telecommunications. Broadcom’s acquisition strategy and focus on enterprise software have diversified its business. The company’s leadership in 5G, broadband, and connectivity solutions makes it a critical supplier for global infrastructure.

Qualcomm Inc.

Qualcomm Inc., headquartered in San Diego, California, leads in wireless technology and mobile communications. In 2025, Qualcomm’s market capitalization stood at $188 billion, with revenue of $37.4 billion and 50,000 employees. The company excels in 5G chipsets, AI-driven on-device processing, and automotive technology. Qualcomm’s Snapdragon platforms power billions of smartphones and connected devices worldwide. The company’s innovations in wireless connectivity and edge computing keep it at the forefront of the semiconductor industry.

SK Hynix

SK Hynix, based in Icheon, South Korea, is a top producer of memory chips. In 2025, the company continued to expand its presence in DRAM and NAND flash markets. SK Hynix increased capital spending by 75% to meet rising demand for AI and data center applications. The company’s focus on high-bandwidth memory (HBM) and advanced packaging supports next-generation computing needs. SK Hynix’s investments in research and manufacturing capacity reinforce its position among leading semiconductor companies.

ASML Holding

ASML Holding, headquartered in Veldhoven, Netherlands, is the sole producer of extreme ultraviolet (EUV) lithography machines. In 2025, ASML’s market capitalization reached $264 billion, with revenue of $29.6 billion and over 42,000 employees. ASML’s EUV systems are essential for advanced chip fabrication at leading-edge nodes. The company’s technology enables semiconductor manufacturers to produce smaller, faster, and more efficient chips. ASML’s unique position as the only supplier of EUV equipment makes it indispensable to the global semiconductor supply chain.

AMD

Advanced Micro Devices (AMD), based in Santa Clara, California, has made significant strides in high-performance computing. In 2025, AMD’s market capitalization reached $244 billion, with revenue of $23 billion and 26,000 employees. AMD’s EPYC server processors have transformed data center performance, while Ryzen CPUs and Radeon GPUs compete strongly in consumer and professional markets. The company’s partnership with TSMC for advanced 7 nm and 5 nm chip fabrication has enabled AMD to deliver cutting-edge products. AMD’s focus on energy efficiency and performance continues to drive its growth in the semiconductor sector.

The following table summarizes key financial and technological metrics for the top semiconductor companies in 2025:

Company | Market Cap (approx.) | Revenue (approx.) | Employees | Key Technological Achievements |

|---|---|---|---|---|

NVIDIA | $1.2 trillion | $55 billion | 26,000 | Blackwell AI chips, leadership in GPUs for AI, machine learning, data centers, automotive, and cloud computing |

TSMC | $500+ billion | $75 billion | 65,000+ | Advanced 3nm and upcoming 2nm process nodes, largest independent foundry |

Broadcom | $1 trillion | $47 billion | 20,000 | AI-powered networking, green energy solutions, enterprise software |

Intel | $92 billion | $55.12 billion | 125,000 | Next-gen chips for computing, cloud, AI; investing in domestic production and foundry services |

AMD | $244 billion | $23 billion | 26,000 | EPYC server processors revolutionizing data centers, Ryzen CPUs, Radeon GPUs |

Qualcomm | $188 billion | $37.4 billion | 50,000 | Leadership in 5G, AI-driven on-device processing, automotive tech |

Samsung Electronics | $400 billion | $75 billion | 260,000+ | DRAM, NAND flash memory, advanced logic chips, supplier for smartphones, cloud, AI |

ASML Holding | $264 billion | $29.6 billion | 42,000+ | Sole producer of EUV lithography machines essential for advanced chip fabrication |

These semiconductor companies continue to shape the future of technology through innovation, investment, and global reach.

Comparison Table

A clear comparison helps readers understand how the top semiconductor companies perform in 2025. The table below highlights important financial and operational statistics. These metrics show each company's strengths and areas of focus.

Company | Market Cap ($B) | Revenue ($B) | Gross Margin (%) | Capex to Sales (%) | Debt to EBITDA | Return on Avg Net Assets (%) | Inventory Turnover | Specializations | Global Reach |

|---|---|---|---|---|---|---|---|---|---|

Samsung | 400 | 75 | 38 | 21 | 1.2 | 12.5 | 5.1 | Memory, Foundry, Logic | Global |

NVIDIA | 1,200 | 55 | 72 | 9 | 0.8 | 18.2 | 7.3 | AI, GPUs, Data Center | Global |

TSMC | 500 | 75 | 54 | 45 | 0.6 | 15.7 | 4.8 | Foundry, Advanced Nodes | Global |

Intel | 92 | 55.12 | 43 | 27 | 2.1 | 9.8 | 3.9 | CPUs, Foundry, AI | Global |

Broadcom | 1,000 | 47 | 61 | 13 | 1.0 | 16.4 | 6.2 | Networking, 5G, Enterprise Software | Global |

Qualcomm | 188 | 37.4 | 58 | 10 | 0.9 | 14.1 | 6.7 | 5G, Mobile, Automotive | Global |

SK Hynix | 120 | 36 | 35 | 24 | 1.5 | 10.2 | 4.5 | DRAM, NAND, HBM | Global |

ASML | 264 | 29.6 | 52 | 8 | 0.7 | 17.5 | 8.1 | EUV Lithography Equipment | Global |

AMD | 244 | 23 | 51 | 12 | 1.1 | 13.8 | 5.9 | CPUs, GPUs, Data Center | Global |

Note: Gross margin shows how much profit a company keeps from sales. Capex to sales tells how much a company invests in new equipment or factories. Debt to EBITDA measures how well a company can pay its debts. Return on average net assets shows how efficiently a company uses its resources. Inventory turnover reveals how quickly products sell.

This table gives a snapshot of the financial health and focus areas for each leader. Readers can see which semiconductor companies invest more in innovation, manage assets well, or lead in specific markets. The global reach column shows that all these companies have a worldwide presence, shaping technology everywhere.

What Sets Them Apart

Top semiconductor companies stand out through a mix of innovation, global reach, and strategic investment. Each leader brings unique strengths to the industry, shaping technology for the future.

One key differentiator is regional dominance. Asia Pacific holds more than 40% of the global semiconductor and circuit manufacturing market. China leads with a 29.32% share, followed by Japan and India. This region’s market size reached $257.38 billion in 2025, with a strong growth rate projected through 2033.

Investment in research and development also sets these companies apart. For example, Intel invested $17.5 billion in R&D in 2022. South Korea committed $470 billion to build the world’s largest semiconductor cluster by 2030. These investments drive new technologies and keep companies ahead in the market.

The following table highlights some of the main differentiators:

Differentiator | Example Company | Statistic/Metric | Year/Period |

|---|---|---|---|

R&D Investment | Intel | USD 17.5 billion | 2022 |

Strategic Investment | South Korea | USD 470 billion for semiconductor cluster | 2024-2030 |

Market Leaders | Intel, Samsung, Qualcomm | Dominant global market share | 2025 |

Employee Count & Global Presence | Intel | 131,000 employees in 65 countries | 2022 |

Global presence remains another factor. Companies like Intel and NXP Semiconductors operate in dozens of countries, employing thousands worldwide. This reach allows them to serve diverse markets and respond quickly to changes in demand.

Note: The combination of strong R&D, regional leadership, and worldwide operations helps these semiconductor companies maintain their edge in a fast-changing industry.

Industry Outlook

The semiconductor industry faces a dynamic future shaped by both opportunity and challenge. Several key drivers will influence the next decade:

Artificial intelligence continues to demand faster and more advanced chips. Companies must innovate to keep up with AI’s rapid growth.

Cloud infrastructure expands, increasing the need for efficient semiconductor solutions.

Consumer electronics evolve, requiring chips that deliver more power while using less energy.

Automotive applications, especially electric and autonomous vehicles, create new demand for specialized semiconductors.

Geopolitical tensions and weather-related disruptions can impact supply chains. Cyclical demand also requires careful management. Major players like Samsung, Micron, and Texas Instruments invest in AI-assisted manufacturing and proactive planning to adapt quickly.

The competitive landscape grows more intense as companies focus on in-house chip design and use AI to improve manufacturing. This shift helps them respond to market changes and maintain leadership.

Forecasts from industry analysts show strong growth ahead. The IDTechEx report predicts that advanced semiconductor packaging will expand across high-performance computing, autonomous vehicles, 5G and 6G networks, and consumer electronics. Shipment and revenue projections cover the next ten years, with detailed breakdowns by product type and region. Technologies such as 2.5D and 3D packaging will play a major role in supporting new applications.

Semiconductor companies that invest in innovation and flexible supply chains will likely lead the industry. Their ability to adapt to new trends and manage risks will shape the future of technology worldwide.

The leading semiconductor companies in 2025 excel through innovation, global reach, and strategic investment. AI-optimized GPUs, advanced foundry services, and strong partnerships drive their growth. The table below shows key industry trends and achievements:

Metric/Trend | Data/Description |

|---|---|

TSMC Market Share (Q1 2024) | |

Taiwan Semiconductor Industry Output | Expected to exceed USD 160.9 billion in 2024 |

M&A Activity Trend | Steady recovery in volume and value growth since H2 2023 despite global economic challenges |

Taiwan's Role in 2025 | Increasingly crucial due to AI-driven demand and industry restructuring |

Industry watchers should look for continued AI breakthroughs, new chip designs, and global supply chain shifts as the next chapter unfolds.

FAQ

What is a semiconductor company?

A semiconductor company designs, manufactures, or sells chips that control electronic devices. These chips power smartphones, computers, cars, and many other products. Leading companies often focus on innovation and global supply.

Why do semiconductor companies matter for AI and 5G?

Semiconductor companies create chips that process data quickly. AI and 5G need fast, efficient chips to work well. These companies help drive new technology in smart devices and networks.

How do companies like TSMC and Samsung differ?

TSMC mainly provides chip manufacturing for other brands. Samsung both designs and manufactures its own chips. Both companies lead in advanced technology, but their business models differ.

What challenges do semiconductor companies face?

Supply chain disruptions, high R&D costs, and global competition challenge these companies. They must also adapt to changing technology and market needs.

Which region leads in semiconductor production?

Asia Pacific leads in semiconductor manufacturing. Countries like Taiwan, South Korea, and China have large factories and skilled workers. This region supplies most of the world’s chips.

See Also

Best Microcontrollers To Use In Embedded Systems 2025

Leading Suppliers Of RF Components For 5G Networks 2025

Emerging Trends Influencing The Analog IC Market In 2025

Breakthroughs Advancing Local Memory Chip Production In 2025